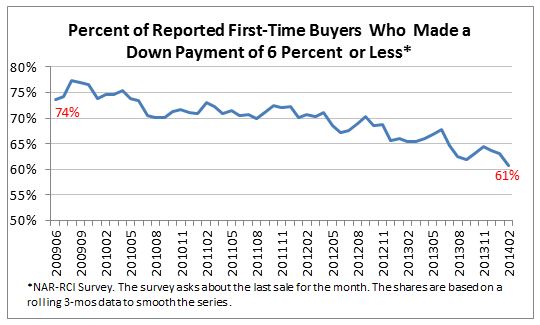

NAR’s REALTORS® Confidence Index Survey data shows that fewer first-time buyers are obtaining mortgages with down payment of 6 percent or less [1]. In 2009, among REALTORS® who reported a sale to a first-time home buyer, 74 percent of these buyers put down 6 percent or less as down payment [2]. As of February 2014, this has fallen to 61 percent.

Along with the re-emergence of private mortgage insurance since 2011, REALTORS® have reported several factors driving this trend: tight competition for available properties, stricter underwriting standards, the higher cost of mortgage insurance at the FHA, as well as a reduction in the high-cost loan limits at which FHA can finance. With demand still stronger than supply across many states, a higher down payment enhances the likelihood of winning the bid and of obtaining a loan from the bank.

For buyers who can put down a higher down payment, doing so lowers the monthly mortgage insurance premium. For example, a house valued at the median price of $189,000 financed with an FHA-insured 30-year fixed mortgage at 3.5 percent down payment will require an upfront mortgage premium (UPMIP) of $3,191 and a monthly mortgage insurance premium (MIP) starting at $209 dollars [3]. A higher down payment of 22 percent will lower the UPMIP to $2,580 and the monthly MIP to $163. For conventional GSE-eligible loans, borrowers don’t typically pay mortgage insurance once the LTV reaches 80 percent. Combined with the lower monthly mortgage payments, the monthly savings from putting down a 20 percent D/P is about $226.